Describe an item you were incredibly attached to as a youth. What became of it?

I never thought I would stop loving Grahame Greene, honestly. He was my first real love. I had an earlier “boyfriend” John Irving. Irving was a middle school romance. I was attracted to how funny he was. I was smitten by his jokes and how absurd he makes everything seem. I hung around Irving’s friends like Kurt Vonnegut and Gunter Grass and pretended to laugh at their jokes and filled their beers when they cried. I never really did clicked with the three of them. Vonnegut I could never get – his jokes were not funny. Grass was sooooooo super cool. Always bringing his pets or toys around – a dog, cat, fish, drum. I loved being part of the cool crowd. At the height of my coolness, Grass introduced me to Thomas Mann. I felt so fancy when I met Mann. He was suave, cool, handsome, funny but never overly cerebrel as if one of those Oxbridge people who have the mythical combination of bright, smart, kind and funny. It was disappointing I wasn’t invited back after a few times. I suppose I wasn’t cool enough.

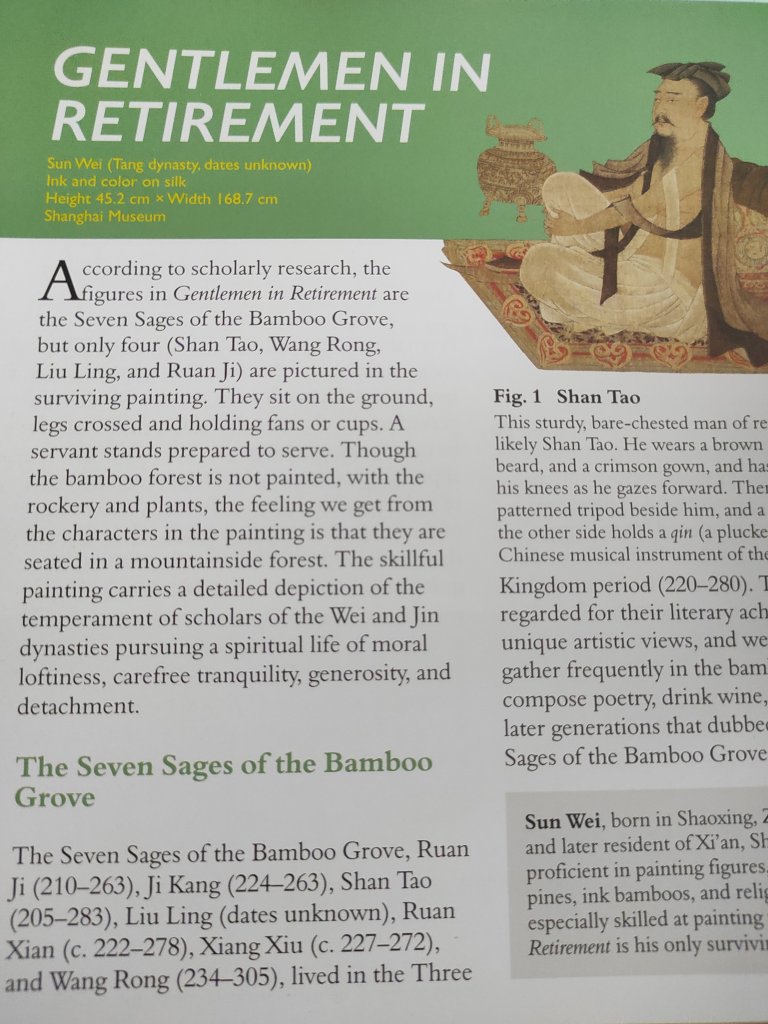

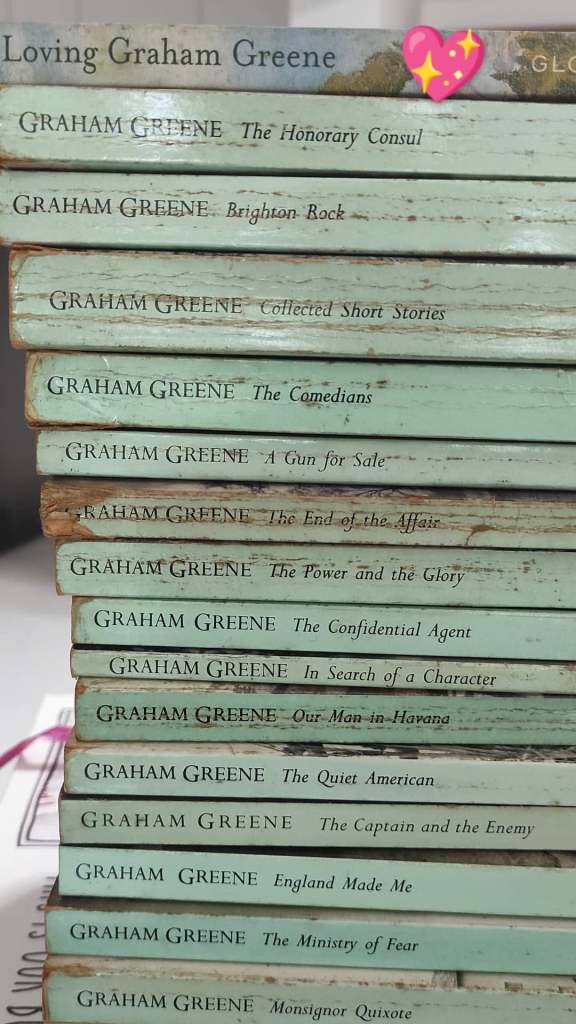

I was totally obsessed with Graham Greene. I have forgotten how we met. There was no big moment. No meet cute. Just a book store and random really there are so many others, you know. Definitely nothing in romance novels or “that it was fate that drew us together”. I didn’t think it would be a lengthy love affair and such an obsession. I even flirted Dostoevsky when we drifted apart. (So worldly wise and so trustworthy. Over the years, Dostoevsky and I became good friends. I cannot always understand what he says when he rambles on but when I need some sorting out, Dostoevsky answers my telephone calls. ) I also remember another in between guy Thomas Hardy. (So many Thomases!) I stuck to Hardy for quite a long while. But throughout this time, it was only Greene who filled my soul. I was drawn to his melancholy, his inner drama. Greene drove to the hilt my intellect and emotions. There was no drama, no shouting, no declarations of love. Just a quiet intensity of emotions. When he dropped me, I was devastated.

Margaret Atwood rallied around. We drank tea and talked about men. Later, I must have been introduced to Peter Carey by someone. He was brilliant – too brilliant. I called Dostoevsky and this time, it was a voice message. Over time, peace and calmness returned. I no longer think about Greene at all. I wonder at myself why the intensity then.

Lately I’ve met a mentor Hilary Mantel. She is so experienced being in the corridors of power. She terrifies me actually. Once you get into the boardroom, she knows your P/L and Balance Sheet, not only your secrets but the secrets of others and she knows how to use them. She is at the same time empathetic yet cunning. 100% scary. I can never have long sessions with her. I don’t tell her about Greene when I talk to her. She has already known and dismissed him.

(I gave away a full collection of Greene’s books a few years ago.)